The insurance industry globally is growing considerably well and is reporting a double-figure growth consistently for the past several years. So, it is quite surprising to learn that on a global level, the adoption rate of new technology and fresh interface paradigms has been meager when it comes to insurance provider companies. There are various challenges in this regard, primarily centered around the multiplicity of use cases, which are, at times, very unique and specific to some instances. These challenges could be a result of the applicable state laws, country laws, user demographics, changes in relationship status, and other similar probable reasons.

With the consumerization of Enterprise apps coming into the mainstream, the designers are proposing new and practical solutions to the existing challenges with backend applications for the insurance sector. But the adoption rate has been a matter of concern for most insurers, which impacts the decision to invest in a redesigning activity.

WHERE CAN IT GO WRONG?

There are two essential checkpoints which must be considered in this regard:

- CASE 01: Concerns for the Business

The call center manager for a leading insurance company is worried about the average waiting time of over 6 minutes for the callers every peak season. She requests assistance with reducing this duration to about 20%.

Conventional Approach:

Easy access to information for Support Staff

An obvious guess of the problem would be to fix the setup at the Call Center, to improve employee efficiency by upgrading the hardware, improving the software, and announcing additional performance-linked incentives. Redesigning the CRM reference portal being used by support executives can help them find the relevant information quicker and close the inquiry at the earliest. All of these actions can make things better for sure. But they certainly require considerable efforts at multiple fronts. And it may not be enough to increase efficiency by almost 80%. Briefly speaking, the ROI is expected to be pretty low.

YellowFirst Approach:

Easy access to information for Customers

Do a thorough ‘Root Cause Analysis’ focusing on the reasons why the consumers need to call for support. Then attempt to fix that by building intelligence into the system communications. E.g., Every 1st January, the summary of the previous year’s portfolio is automatically sent through SMS/ Emails. This gives the customers the information that they need exactly when it matters the most for them. They would not need to call for this information anymore. Such interventions may apply across multiple scenarios. Lesser number of calls would mean reduced load on the support team, thereby reducing the waiting period. Problem solved!

- CASE 02: Concerns for the Facilitators

The Head Trainer for a legacy financial product is facing a challenge in training the new joiners about their regular tasks. The trainees fail to remember the finer nuances learned from the training while performing their job. He requests assistance with making the training material more comfortable to consume so that they can easily remember.

Conventional Approach:

Simplify training material

Create a detailed Training workbook that focuses on improved content categorization, supporting it with visual aids elaborating real-life use cases. Also, provide them handy flash-cards for each critical task, which they can pin on their workstations for quick reference.

YellowFirst Approach:

Reduce training requirement

Understand the usage pattern and objective of the products and identify the demographics and psychographics of the end-user profiles. Accordingly, redesign the application to make it highly contextual and accurately aligned to the mental models of the users. This methodology would help them associate with the application naturally, thereby reducing the need for any training in the first place. Problem solved!

- CASE 03: Concerns for End Users

A dynamic young fresher from an excellent university joined a reputed financial institution. She went through an extensive training program and faired well in all of her tests. But when she was assigned a job, her lack of experience made her feel nervous. She felt much pressure to avoid any mistakes in calculations and paperwork. This pressure is typical in financial firms because their employees handle high-value transactions, which puts them at risk if they make a mistake. She wants a tool to review her tasks for any possible errors.

Conventional Approach:

Create multi-level review system

Create a tiered review system for critical tasks, which allows leveraging the experienced eyes of senior employees. This makes the system fail-safe against possible human errors and ensures high credibility.

YellowFirst Approach:

Create a proactive system that does the heavy lifting itself

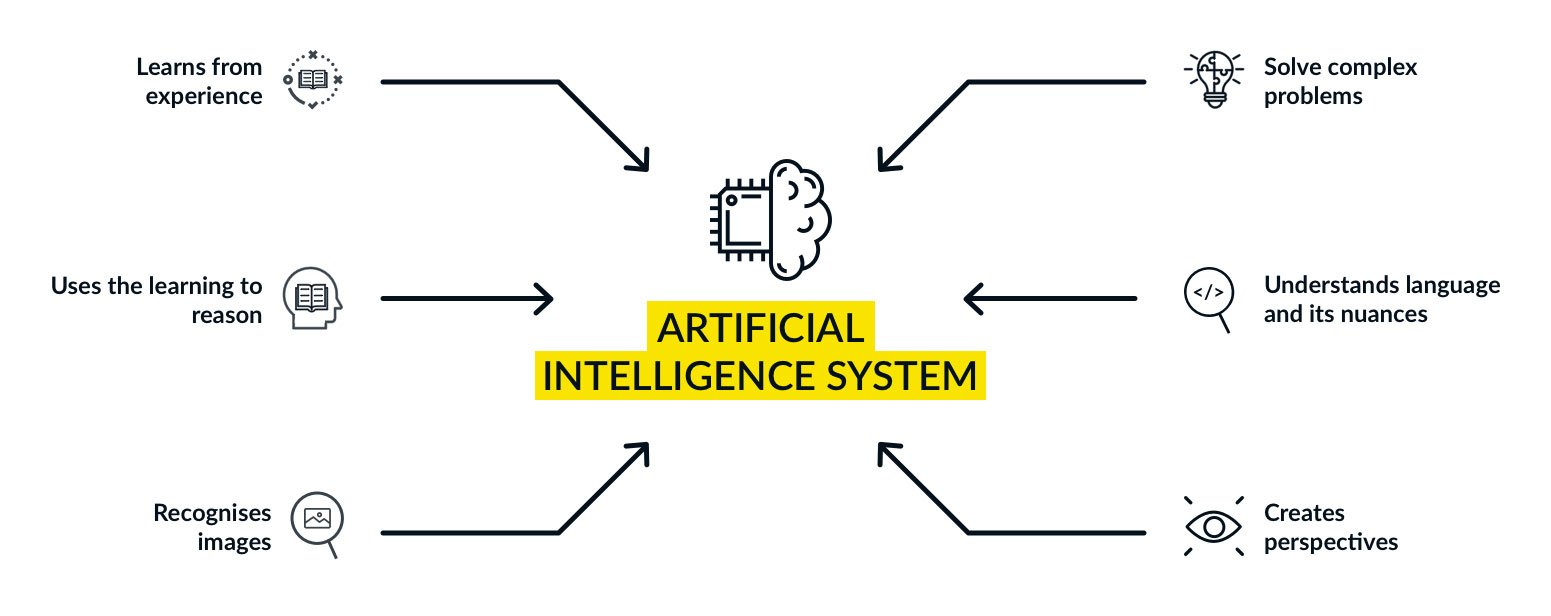

Create a system that learns from the available database to be able to identify a reasonable suggestion for regular tasks. It just requires the users to validate the proposal before committing it. This leverages the capabilities of the machine, reduces time, and eliminates errors. It ensures that even the newest employee is as capable as the one with 20 years of experience. Building a consumerized behavior into the product further allows customizations that can help her personalize the application as per her comfort level and requirements. Problem solved!

- CASE 04: Concerns for 3rd Party Associates

A sharp investment broker visited a firm for business prospects. He realized that a better understanding of the firm's previous investment pattern and preferences would have equipped him better. He requests a more convenient way to access vital Client information so that he can assist them better.

Conventional Approach:

Create an interactive search tool

Create a fully functional and interactive search tool for finding historical information about any client portfolio. This tool would allow the agent to infer the client requirements and relevant sale opportunities. This feature would, however, breach an essential aspect of data privacy.

YellowFirst Approach:

Create a common tool that instills trust and benefits both parties

Create an aggregator which allows Clients to willingly recognize access to specific information about their investment portfolio to registered agents, to get a quote for specific requirements. In this way, the system would ethically expose the data to a limited group of agents. The agents, on the other hand, would be able to get a much better understanding of what the client is looking for. This also establishes the system as a transparent platform, where people can openly share sensitive financial information. Since the application already has access to the client’s information as well as broker’s offerings, it can auto-suggest a few options for cross-selling or upselling. It ends up being a win-win situation for either party, with brokers getting better business and Clients getting tailored options from multiple experts. Problem solved!

“Everything we love about civilization is a product of intelligence, so amplifying our human intelligence with artificial intelligence has the potential of helping civilization flourish like never before – as long as we manage to keep the technology beneficial.”